Supermicro (Pt.1) - Understanding SMCI's Differentiation Vs. DELL & ODMs

Summary

- This is a three-part report on Supermicro. Part 1 discusses its differentiation vs. OEMs and ODMs. Part 2 will cover the vendor's influence on SysMoore. Part 3 will discuss the current fraud allegations.

- Super Micro Computer (SMCI) has seen explosive growth due to its strategic partnerships, especially with NVDA, and its innovative Building Blocks Architecture.

- Despite strong fundamentals, SMCI's stock has declined due to rumors of sales deceleration, short-seller fraud allegations, and speculation about losing favor with NVDA.

- SMCI's unique blend of OEM and ODM practices, aggressive sales culture, and strategic Silicon Valley location provide a competitive edge in the server market.

- The company's alignment with the Open Compute Project and focus on predictive maintenance and AI growth position it well for future scalability and efficiency.

Introduction

Super Micro Computer (SMCI) has experienced a meteoric rise in the wake of the generative AI revolution, which has spurred an unprecedented rush to procure NVDA GPUs and integrate them into data centers. As NVDA's long-standing partner and a leading server vendor, SMCI has reaped substantial benefits, manifesting in explosive sales growth and significant share price appreciation.

However, since reaching its peak of $1,200 in March 2024, SMCI's stock has experienced a steady decline despite the company's continued growth and solid execution. This downturn can be attributed to a confluence of factors, including:

- Rumors of potential sales deceleration

- Short-seller reports unveiling potential fraud

- Speculation about SMCI losing favor with NVDA to competitors like Dell

Given SMCI's inherent volatility and its sophisticated investor base, the company's share price has undergone a significant correction since its March zenith. The situation was further exacerbated in late August when Hindenburg Research released a long-anticipated short-selling report, precipitating another substantial drop in SMCI's stock price.

In this report, we won't delve into our perspective on the fraud allegations and broader short-selling thesis. For these topics, we will write a separate note, exploring possible outcomes accompanied with scenario valuation analysis. Our primary focus for this report will be on SMCI's fundamental business operations. Our analysis assumes that SMCI remains a viable enterprise, free from the spectre of delisting, major executive reshuffles, or material changes to its financial results.

SMCI emerged as a server motherboard manufacturer in 1993, founded by Charles Liang in the heart of Silicon Valley. Initially, the company faced skepticism from investors who viewed the market as oversaturated, with SMCI lacking any apparent unique selling points. Undeterred, Liang turned to his family, securing capital from his siblings to breathe life into his vision.

In a display of familial entrepreneurship, Liang's brothers followed suit, establishing sister companies that complemented SMCI's offerings. These included Ablecom (server chassis), Compuware (server power supply units), and Leadtek (exclusive AIC for NVDA workstation GPUs), creating a small ecosystem around SMCI's core business.

SMCI carved its niche by pioneering rapid adoption of the latest Intel CPUs. While competitors typically required 3-6 months for validation and testing to ensure reliability across various voltage and temperature conditions, SMCI's innovative approach slashed this timeline. The company's breakthrough lay in its modular and flexible motherboard design, enabling swift adaptations to support cutting-edge chips with minimal modifications.

The company's success was fueled by an unwavering commitment to rapid prototyping and an intense focus on optimizing the configuration of the server components for optimal performance. SMCI cultivated a work culture that stood out in Silicon Valley's hardware landscape, more closely resembling the intense dedication seen in some Asian companies. Employees routinely worked extended hours, including nights and Saturdays, echoing the driven approach championed by tech luminaries like Elon Musk's companies, such as Tesla and SpaceX.

This unique blend of innovation, agility, and tireless dedication propelled SMCI from its modest beginnings to become a formidable player in the server technology arena.

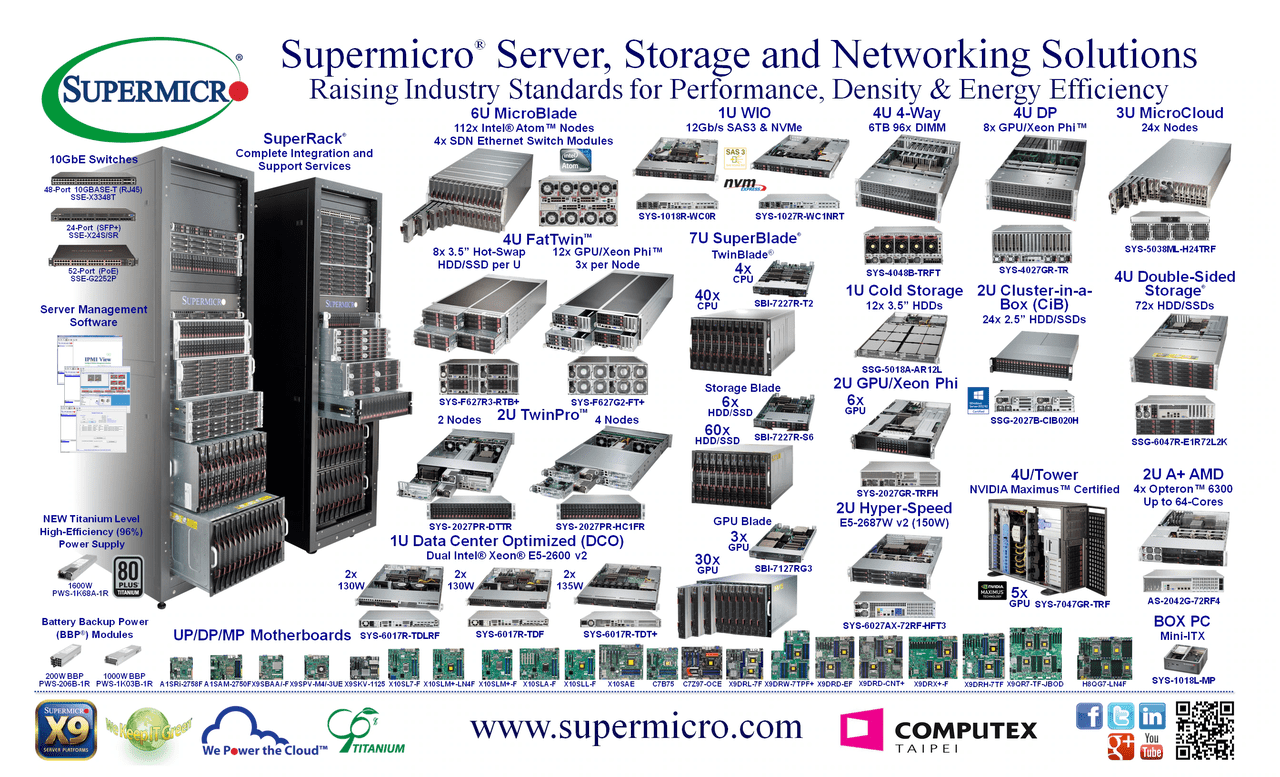

Building Blocks Architecture

SMCI's core competency in motherboard design evolved into its groundbreaking Building Blocks Architecture, a modular approach that revolutionized server customization. This innovative system allows customers to handpick components, creating bespoke servers that precisely match their requirements, rather than settling for off-the-shelf solutions that may only satisfy 80% to 95% of their needs while including unnecessary features.

The Building Blocks Architecture represents SMCI's most significant competitive advantage and value proposition in the highly commoditized and fiercely competitive server market. It enables SMCI to differentiate its products and command higher gross margins in an industry where vendors often struggle to stand out.

This modular design not only enhances customization but also amplifies SMCI's already impressive speed-to-market for new motherboards. While the entire server typically requires comprehensive testing after a new chip release, SMCI's architecture allows for targeted testing of only the modified components and newly designed areas. This approach dramatically reduces the time and resources needed for validation.

In contrast, competitors relying on monolithic architectures face significant hurdles. Their tightly integrated designs make tailoring servers for individual customers impractical and slow down the introduction of new-generation servers following chip releases. Any modification in a monolithic server necessitates retesting the entire system, a process that's both time-consuming and costly, especially when identifying and resolving bugs.