Updates: S 2Q24 - Rebound & M&A Thesis

Summary

- With the prior accounting issue resolved, a stabilizing IT budget environment, and improved business execution, S has driven a strong reacceleration reflected in S' QoQ growth.

- The selloff post 2Q23 forced the majority shareholder to explore M&A options for an expedited exit. We believe this is more driven by the LPs rather than fundamental business issues.

- The number of potential strategic and financial buyers for S is very few. We review the landscape of possible buyers.

- We reaffirm our previous thesis that S should be able to compound its execution and improve profitability as it scales. On a risk-reward basis, we believe the turnaround case is attractive.

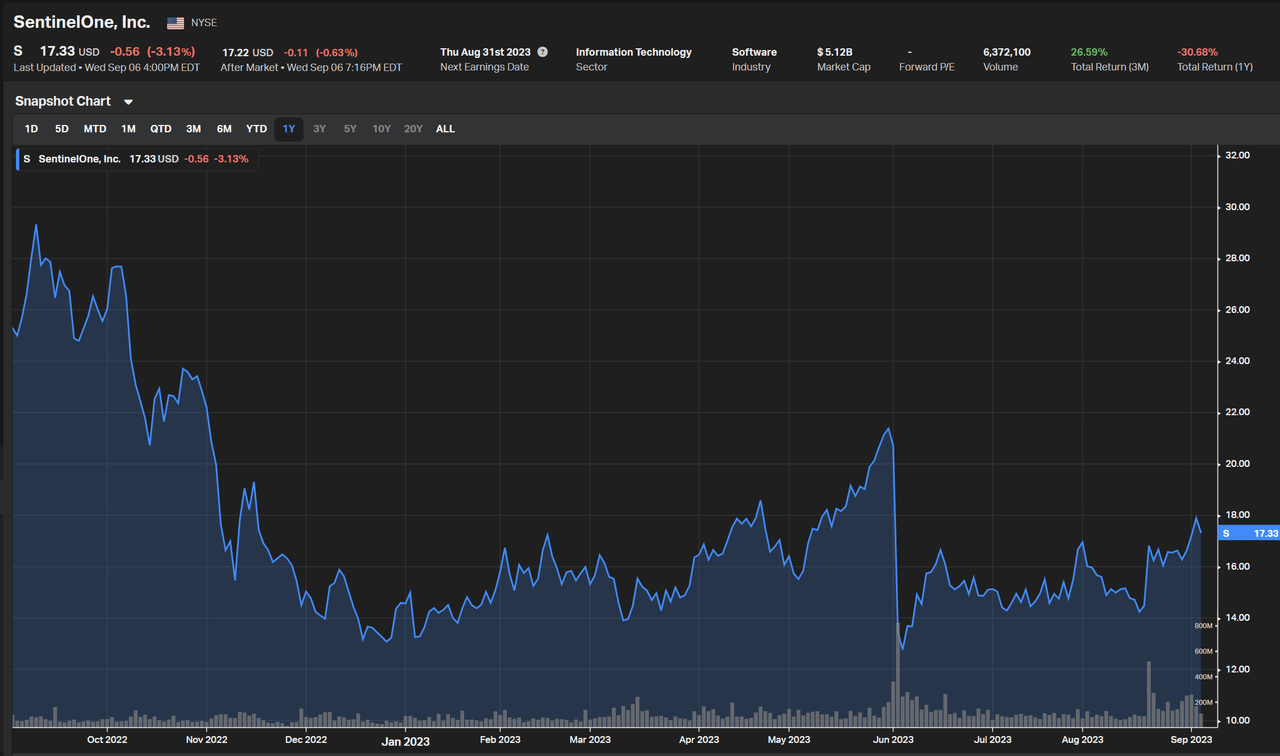

Recapping the price-action

After the 2Q23 ER share price plummet, it was clear that the sentiment had turned to extreme bearishness. One indicator is that analysts started to speculate on further downside cases and accusing management of being inexperienced, and suggesting that beneath the ARR miscalculation are deeper problems.

After a thorough review and thesis checks, we believe most of these speculations, though warranted, are not reflected in the company's business performance as it relates to product velocity, execution, and competitiveness.

However, the real driver of the recent price gains is the rumour that S has hired Qatalyst to explore potential M&A options, vis-a-vis selling the company to unlock the value given the multiples are at a significant discount compared to growth peers.

We are surprised by this move given the fact that the fundamentals of S aren't so dire, and it should have at least a few more quarters of execution to prove itself, unless insiders are seeing a different picture going forward.

After this news, the share price gapped up again as potential buyers have to pay higher premiums to existing public investors. Subsequently, after this good ER beat, the share price melts up again.

Financial metrics

To access the following table and DCF valuation models, click the link.

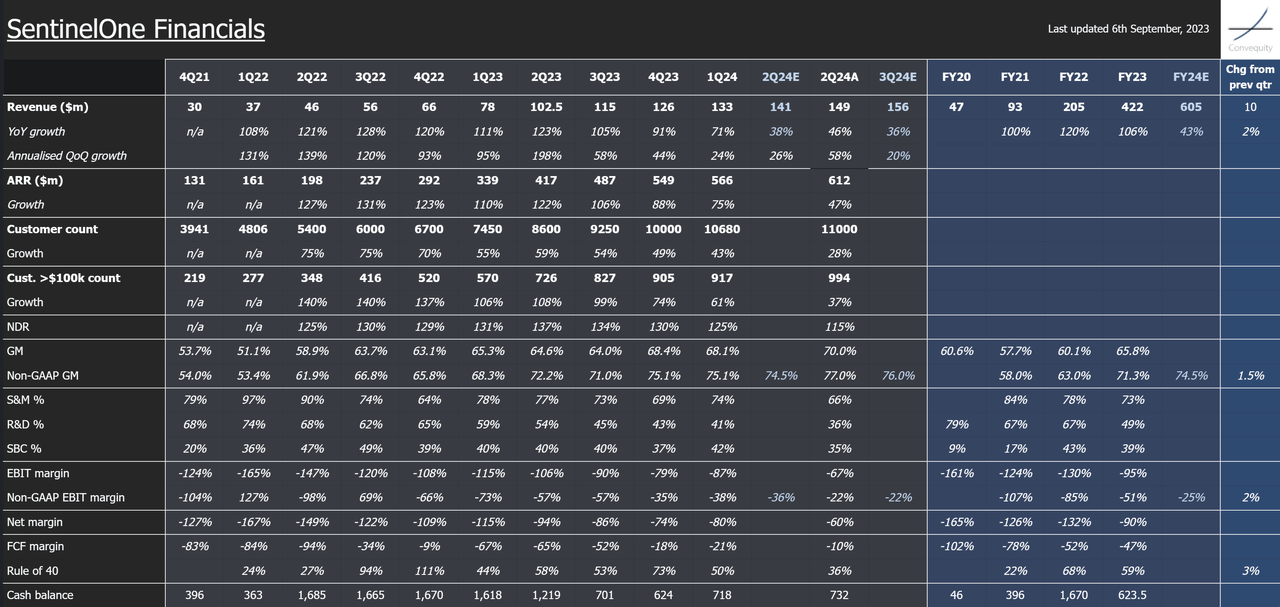

Total revenue grew 46% YoY to $149 million in the second quarter. International revenue represented 36% of total revenue, reflecting growth of 57% YoY. It is rare to see a U.S. enterprise-focused cybersecurity company to have higher growth internationally. Usually, higher international growth is a good sign that the company's product is more cost-effective and a leading indicator of the future U.S. sales success.

The cloud-related security business is over 20% ACV. This shows the Wiz security partnership is working very well, and it could potentially be another contributor of this quarter's growth reacceleration.

Like many other cybersecurity companies expanding to the platform strategy, S now has 30% of revenue coming from non-endpoint security business.

The biggest surprise this quarter is that S has dramatically improved its execution with $49m of net new ARR that drives its aQoQ number to 58%. On a YoY basis, the revenue grew 46%, driven by 115%+ NDR and 30%+ customer count growth.

This means that ~2/3 of S growth comes from new customers rather than existing upsell/cross-sell. Coming into 2023, most high growers managed to slow the growth decay thanks to their strong footing in enterprise customers, which gives them a platform to sell them more products at lower prices. As such, S' ability to grow more from new customers shows its product strength and continued ability to win replacement deals.

However, on the other hand, the 115%+ DBNR print, partially dragged down by the legacy products of Attivo, shows that S' ability to expand the cohort is still in trouble. This is potentially attributed to the continued cost-cutting from S customers, most of which are more cost-sensitive versus CRWD's customers.

S' most lucrative business is data retention. The longer customers save their EDR/XDR and other log data on S' DataSet platform, the more they have to pay, and the price of saving one endpoint's security data for 12 months could be even higher than the price of its license.

Looking into margins, S continues to scale its gross margin, as we've anticipated. It achieved a higher gross margin faster than our expectation, and this is done not by raising the price but by better scale and optimization. Again, this reaffirms S' architectural advantage.

GAAP EBIT margin was -67%, 39 percentage points of improvement compared to -106% in 2Q23. Non-GAAP EBIT was -22%, 34 percentage points higher compared to -57% in 2Q23.

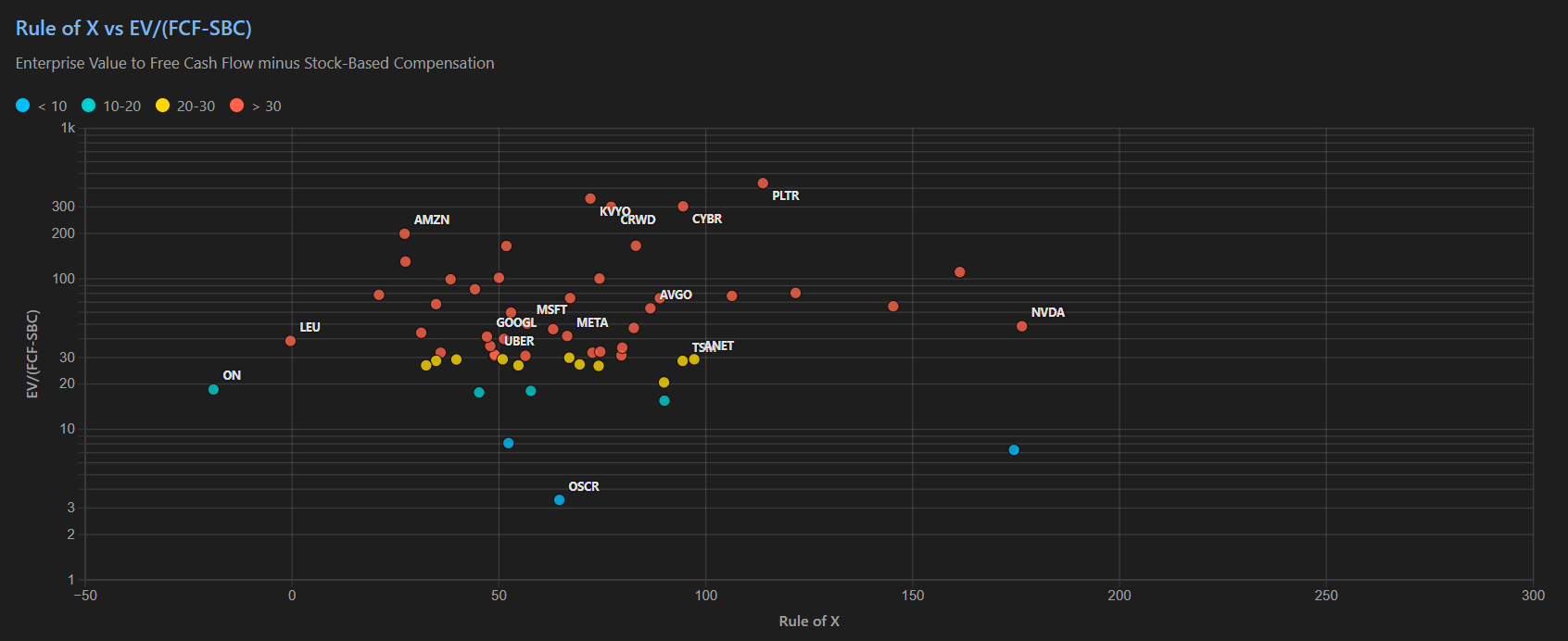

GAAP EBIT margin is still a big issue that S has to handle better. The Rule of 40 is just breakeven if you adjusted for the SBC of 35%, and unlike SNOW or PANW, S isn't cash rich enough to buy back shares for sterilization.

To keep up with CRWD, S has a more bloated R&D %, but we expect it to come down as it scales up. Overall, we believe that S is continuing to make improvements on both GTM and operating efficiency. It should be able to reach its breakeven EBIT target, but investors still need to see more operating efficiency improvements.

Product Fundamentals

Wiz partnership

The biggest surprise to investors is that S' management sent an internal email to sales teams, mentioning the Wiz reselling agreement was terminated, just days before the ER and one day after Wiz expressed its interest in making a bid for S.