Valuation Analysis: Rule of X vs. Multiples

Summary

- Reports on Confluent, Rubrik's IPO, and Match Group are on the way.

- In this short report we share simple relative valuation analysis using the Rule of X.

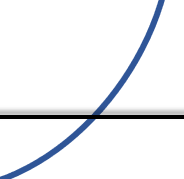

In a previous post we mentioned we're replacing much of our Rule of 40 analysis with the Rule of X after digesting the work by Bessemer Ventures.

Based on their analysis, they found that company valuations have a stronger R^2 with revenue growth than they do with FCF margin. Bessemer, rightly so, attributes this to the notion that growth has a compounding impact on value while FCF margin has a linear impact.

Imagine company X is expected to grow at a CAGR of 30% over the next 10 years with a static FCF margin of 10%. Company Y is expected to grow at a CAGR of 10% over the next 10 years with a static FCF margin of 30%.

Company X: 1.3^10 * 0.1 = 1.37

Company Y: 1.1^10 * 0.3 = 0.78

This simple calculation illuminates the compounding effect of growth and the linearity of FCF margin on future value. Though this will only be the case over a long-term period; a 5-year period would show that 10% growth and 30% FCF margin is better.

With that, Bessemer claims that growth should be valued at 2-3x more than FCF margin, with 2.3x being the median. When we find some spare time, we are going to do our own research on this topic to check the validity of the claims. Here is the Rule of X formula:

Rule of X = (NTM growth * multiplier) + LTM FCF margin

We're using a multiplier of 2.3x (the median from Bessemer's analysis) and we're adjusting the equation to include SBC.

Rule of X (inc. SBC) - (NTM growth * 2.3) + LTM FCF margin - LTM SBC

Whether to use a LTM or NTM metric for FCF is something we ponder on. FCF forecasts, compared to income statement items like EBIT or closer derivatives like EBITDA, have greater dispersion and estimation error. This is in large part because FCF is more affected by external factors impacting working capital and deferred revenue. Forecasting capex can also be challenging for analysts to get right, unless there is very clear management guidance. So, this is our first reason for not using NTM FCF. Our second reason is that we like to do the FCF multiple analysis by including SBC, though SBC is not an item that is available from analysts forecasts. And the third (and less significant) reason is it's not easy to gather the NTM EV/FCF metric from any of our data providers.

Despite our reasons for using LTM FCF, we are very open to using NTM FCF going forward, and would like to hear your thoughts on the matter.

Anyway, back to the analysis. In the following three charts, we show scatter plots with the Rule of X (either Bessemer's version or our SBC-adjusted version) on the x-axis and the multiple on the y-axis. The stocks under analysis include our core domain stocks associated with cybersecurity, data, and productivity, but we've expanded the selection to include some consumer tech names (as we will be adding coverage to some of these names in the near future).

In the 1st chart there is Rule of X (inc. SBC) on the x-axis and EV/(FCF-SBC) on the y-axis.